Will Western Governments Adopt New Policies to Address China’s Nickel Market Manipulation?

By Rob Strayer

China’s outsized role in the global critical minerals supply chain is a growing national security concern for the United States and its allies. Chinese policies and commercial actions that drive volatility in critical minerals prices are becoming better understood. However, the willingness of Western governments to deploy policy responses has lagged. But that is almost certain to change.

China is on its way to dominating the entire supply chain for nickel, and it therefore, provides a great case study and rationale for government counter-action. Nickel is best known for being an essential ingredient in stainless steel and, in the last few years, in EV batteries. Nickel is the most prevalent metal by value in high-performance EV batteries.

Following a decision by the Indonesian government to ban the export of unprocessed nickel ore in 2020, aimed at encouraging the development of domestic nickel processing facilities, China through state-owned enterprises and its Belt and Road Initiative has poured investment into Indonesian processing facilities.

The vertically integrated mining and processing of nickel in Indonesia catapulted it to the world’s largest producer in just a few years. China’s investment of $11 billion in a few years resulted in Indonesia going from having only two nickel smelters in 2020 to 43 operating in 2023, with dozens more planned, according to a recent CSIS report.

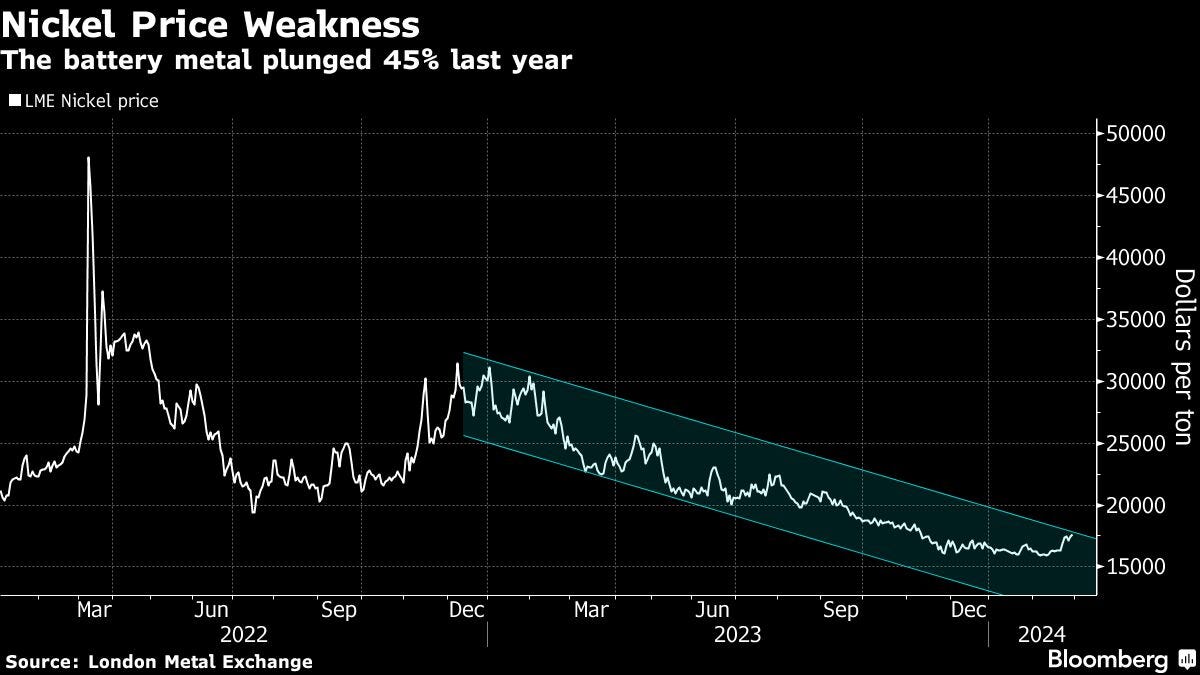

The massive Chinese-backed new supply has plummeted the price for nickel last year from $30,000 per metric ton to $17,000 per metric ton. Half of global nickel operations are unprofitable at these levels. Mines in Australia and other countries are ceasing operations, as noted in this Wall Street Journal article. The next stage will be Chinese offers to purchase these underwater assets, and increasing its control of future supply and pricing for this vital commodity.

Interesting questions include: Exactly how much Chinese government Belt and Road financing and state-owned-enterprise subsidies have been used to capitalize these processing facilities? How many non-chinese-owned mining and processing operations are profitable at these prices globally? And how much do Chinese EV makers benefit from having access to this very cheap nickel in vertically integrated supply chains with their battery component makers?

Governments are under increasing pressure to take actions to limit the impact of this predatory behavior. Already governments have enacted increased tariffs on the importation of Chinese-produced minerals (to the U.S.) and blocked new Chinese investment in critical minerals (Australia and Canada). But these have had minimal impact on the trend.

The Critical Minerals Forum is producing cost-based prices for nickel and other critical minerals. We will transparently show the cost drivers of nickel. It will then be up to the private sector and government to use these models in order to inform policy and decisions and about investments in nickel, when the status quo is not sustainable.